I started making blind trades without any real strategy. However, unbeknownst to me at the time was my sheer lack of knowledge and experience. I wanted in – I wanted a taste of that mone y. I had witnessed a lot of my friends and acquaintances taking huge gambles and making thousands almost overnight. I was a young and hungry investor at the time, completely new to stock investments. Why Should You Practice Stock Trading?īefore proceeding any further, I just want to quickly share with you how things went from bad to worse for me, simply because I failed to take paper trading seriously. Trust me, I’ve been there and don’t want you to be in the same position. The benefit lies in the practice of making real trades without real money, because frankly speaking, newbie stock trading can be a scary thing. When you plan to invest any given sum of money, you’d want to see the effect it has before you actually take the plunge with real money. Paper trading is very useful for a number of reasons.

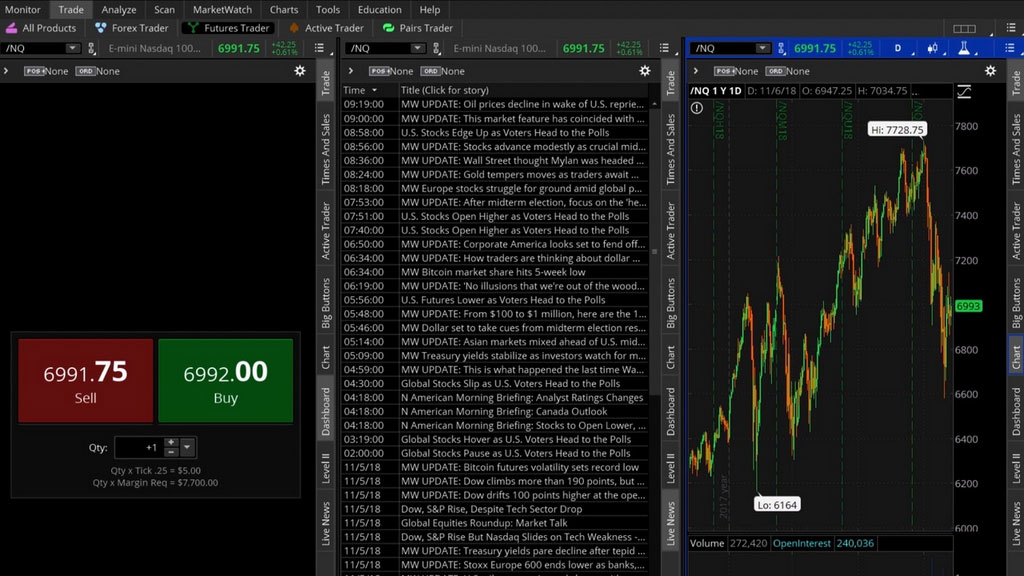

Paper trading is basically the notion of trading with fake or pretend money to see what outcome your investment decisions might lead to. All rights reserved.To effectively make use of paper trading practices, we’re going to make use of paper money or “fake” money, if you will. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.īrokerage services provided by TD Ameritrade, Inc., member FINRA/ SIPC, a subsidiary of The Charles Schwab Corporation.

The firm was rated #1 in the categories "Platforms & Tools" (11 years in a row), "Desktop Trading Platform: thinkorswim®" (10 years in a row), "Active Trading" (2 years in a row), "Options Trading," "Customer Service," and "Phone Support." TD Ameritrade was also rated Best in Class (within the top 5) for "Overall Broker" (12 years in a row), "Education" (11 years in a row), "Commissions & Fees" (2 years in a row), "Offering of Investments" (8 years in a row), "Beginners" (10 years in a row), "Mobile Trading Apps" (10 years in a row), "Ease of Use" (6 years in a row), "IRA Accounts" (3 years in a row), "Futures Trading" (3 years in a row), and "Research" (11 years in a row). TD Ameritrade was evaluated against 14 other online brokers in the 2022 Online Broker Review.

("Schwab"), member SIPC, is a separate but affiliated subsidiary of The Charles Schwab Corporation.

0 kommentar(er)

0 kommentar(er)